Pandemic to trigger health benefit cost hike next year

Employers can expect health benefit costs to rise 4.4% on average in 2021, compared to 2020, according to early results from the Mercer consulting firm’s National Survey of Employer-Sponsored Health Plans 2020. That looks surprisingly “normal”—until it’s viewed in the context of employee wage growth, which has fallen to near zero this year.

The projected cost increase is largely in line with the average annual cost growth over the past six years. Mercer based the projection on an analysis of 1,113 employer responses gathered since early July.

The wild card driving higher health benefit costs: The coronavirus pandemic.

Health plans face many unknowns in developing cost projections for 2021. According to Tracy Watts, a senior consultant with Mercer, “Different assumptions about cost for covid-related care, including a possible vaccine, and whether people will continue to avoid care or catch up on delayed care, are driving wide variations in cost projections for next year.”

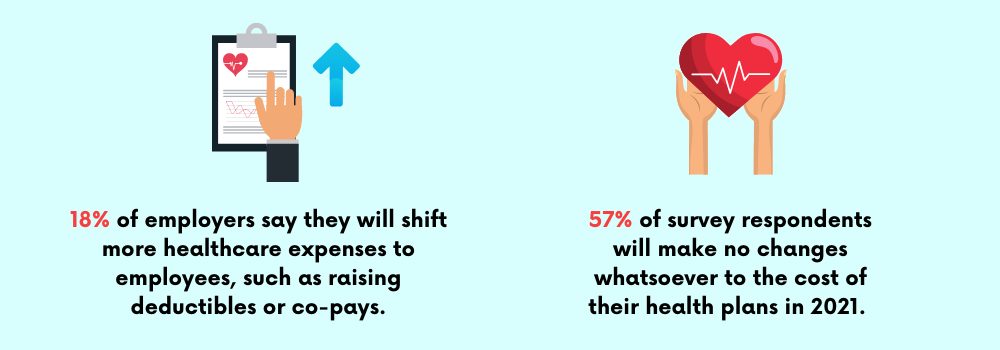

Even amid economic uncertainty caused by the pandemic, only 18% of employers say they will shift more healthcare expenses to employees, such as raising deductibles or co-pays.

In fact, 57% of survey respondents will make no changes whatsoever to the cost of their health plans in 2021. That compares to 47% making no changes last year, and just 44% in 2018.

Contrast that with what happened the last time the economy cratered. In 2008, many employers trimmed health benefits to save money. “Given all the turmoil employees have been through this year, employers are putting big changes on hold, looking to balance economics with empathy,” Watts said.

In fact, many employers are adding new resources to support and engage employees in the coronavirus era. At the top of the list: virtual office visits and other digital healthcare resources. Twenty-seven percent of all employers (and 37% of those with 5,000 or more employees) are adding or improving digital healthcare resources, such as telemedicine and “text a doctor” apps.

To address the stress brought on by the pandemic, 20% of employers are adding or improving behavioral health benefits.

Coronavirus driving open enrollment interest

Expect employees to pay extra attention to their benefits choices during the upcoming open enrollment season. New research from the MetLife insurance company suggests the coronavirus pandemic has left employees keenly interested in making smart choices about their benefits elections.

According to MetLife, employees will be taking “more deliberate action on the benefits options, looking for greater understanding of how each product and service fits into their own personal life experiences.”

The pandemic has raised to red-alert levels employee concerns about their own and family members’ health and the financial disaster that could follow a bout of serious illness.

The specter of unexpected expenses weighs heavily on employees’ minds, a worry many employers say they are ready to address. MetLife found that:

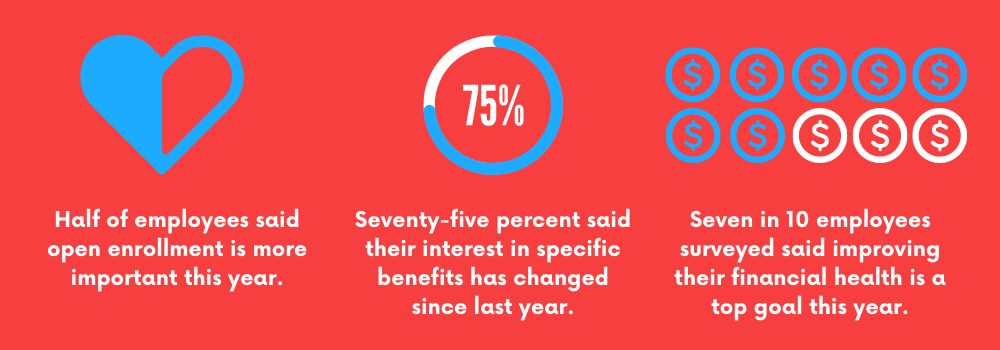

Half of employees said open enrollment is more important this year than it was in 2019. Two-thirds directly attributed the shift in their perspective to the threat of covid-19; 34% specifically cited pandemic-related financial worries and 31% specifically mentioned fear of high healthcare costs.

Seventy-five percent said their interest in specific benefits has changed since last year. More interest in life insurance benefits led the way, cited by 27% of those surveyed. Dental insurance is getting a fresh look, too, cited by 24% of employees. Other benefits sparking renewed interest include pre-tax health savings accounts, vision insurance and access to financial planning tools.

Employees seem eager to take greater control of their finances. Seven in 10 employees surveyed said improving their financial health is a top goal this year. Healthcare costs are a particular concern; 65% said they wanted more control over how much they pay for health benefits.

A separate survey by the Employee Benefit Research Institute found that many employers are responding to heightened employee concerns by beefing up financial wellness benefits offerings. More than half of HR and benefits executives surveyed said their financial wellness benefits budget would increase in the next one to two years.