New W-4: 12 frequently asked questions on employer compliance

As if 2020 hasn’t been enough of a whirlwind, on January 1, 2020, the IRS issued a new form W-4, leading to more than nine months of questions and confusion from both employees and employers.

That’s because there were drastic changes to the W-4 without clear answers regarding implementation compliance.

No pay period withholding and no withholding allowances aren’t the only changes that have and will continue to complicate the wage withholding process for employers.

Since we don’t want the IRS to put a target on your back or your employees to be under-withheld this year (they won’t be happy about paying more to the IRS in 2021), here are 12 of the most frequently asked questions about the new W-4 to help you better understand it and be in compliance.

Why did the 2020 W-4 change?

The 2020 Form W-4 changed to simplify the form and offer a more transparent and accurate withholding system.

This is the most significant overhaul of the form in decades and will take some getting used to.

There are more straightforward questions on the worksheet that help employees more accurately determine how much they want to withhold.

Why is the new W-4 so complicated?

The changes aren’t meant to be complicated.

The goal was for the IRS to reduce complexity while increasing transparency and accuracy of the withholding system. This was done in response to the federal tax code from the Tax Cuts and Jobs Act, which was passed in 2018.

Is the new W-4 better?

If you ask most employers or employees this question, the answer is likely no. However, over time and with more information, it will hopefully become easier to use and understand while achieving more accurate and transparent withholdings.

What is different about the new W-4?

The better question is, what isn’t different about the new W-4?

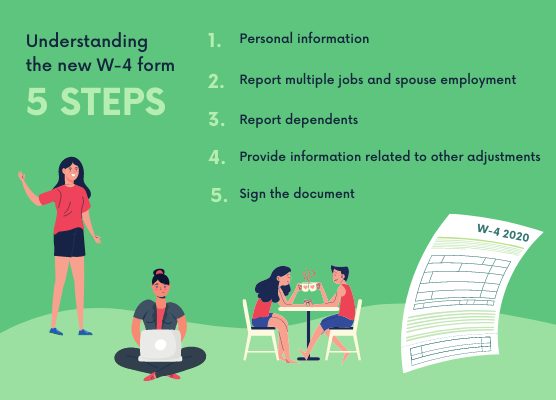

There are 5 general steps to complete the form

Step 1: Personal information

Step 2: Report multiple jobs and spouse employment

Step 3: Report dependents

Step 4: Provide information related to other adjustments

Step 5: Sign the document

It’s important to note that only steps 1 and 5 are required. So, the only information that must be provided by employees is their name, address, filing status, and signature.

They can then choose to complete steps 2-4 for more accurate withholdings. Doing so will allow them to provide information related to

- A 2 income household

- Other income

- Tax credits

- Deductions

Employees can still choose an additional amount to withhold per payroll period, for any reason. This did not change.

Do all employees need to fill out a new W-4 for 2020?

No. Here’s a breakdown of the most common employment scenarios related to the W-4

Will need to complete the new W-4

- All new hires

- Employees who completed a Form W-4 before 2020 and want to make changes to their withholding in 2020

Will not need to complete the new W-4

- Existing employees hired before 2020

Employees who don’t need to fill out a new W-4 will be fine because their employers will continue to determine their withholding based on information from the previously submitted Form W-4.

Also, keep in mind that existing employees can leave their prior W-4 on file indefinitely, so you want to be prepared to support the preceding W-4 and allowances indefinitely.

Do I need two payroll systems – one for the new W-4 and one for the previous W-4?

Not exactly.

You can choose to operate from two separate systems or use the same one. This option depends on what works best for you, but using the same system can simplify your payroll process.

How this works is that the same set of withholding tables are used for both forms.

You can enter 0 or leave blank information from the old form when using the new form, while all data from the old records you have on file will remain.

What do I do about employees hired in 2020 who don’t submit a Form W-4?

If a new employee doesn’t submit a Form W-4, you will treat them as a single filer with no adjustments. Doing so will provide them with a single filer’s standard deduction with no other personal information taken into account.

How do I explain to employees how to complete the new 2020 W-4?

Whether an employee needs to complete the new Form W-4 or chooses to, you don’t want to just hand them the form and hope for the best. This can lead to inaccurate completion, frustration, and confusion due to the changes.

Instead, you want to have a plan in place for supporting employees as they complete the form, whether that’s being present with them, offering a pre-recorded training, or having a go-to contact for W-4 questions.

Can I request that all of my employees, whether they were hired before 2020 or not, submit a new W-4?

Yes, you can request this, however, remember that this isn’t a requirement.

With your request, you want to be sure to note the following:

- They are not required to complete the new W-4

- If they don’t submit the new W-4, their withholdings will continue based on their previous W-4

If employees choose not to do so, you can’t treat them as though they failed to furnish a Form W-4 because it’s not the new Form W-4.

If mistakes were made on previous pay periods, what do I do?

If you made mistakes on withholding during previous pay periods while you were figuring out the system, it’s your responsibility to make the necessary corrections. If not, the IRS could put a spotlight on your business, which you don’t want. Your employees could also be required to make those adjustments in 2021 with a more massive tax bill.

How do I handle employees who were rehired during the pandemic instead of on furlough or called back?

Employees who are rehired must complete a new W-4. However, employees returning after a furlough or call back don’t have to complete a new form because they remained employees throughout the time they weren’t working.

My third-party payroll provider didn’t implement the new W-4 and withholding rules properly. What do I do?

First, you want to ensure that they have more clarity before moving forward. Ultimately, any mistakes made will have to be fixed. At the end of the day, your company, not the payroll company, will be responsible for the numbers that come back, and if anything is incorrect, the IRS and your employees will expect you to make it right.