How to comply with the 2020 W-4 and withholding changes

Updated 12/3/19

For decades, payroll departments have used two basic principles to withhold income taxes from employees’ pay: Employees indicate the number of their withholding allowances on their W-4s and you figure their income tax withholding based on those W-4s and your pay period.

That’s about to change, thanks to the Tax Cuts and Jobs Act. The TJCA suspends the personal exemption amount, which doubles as the annual withholding allowance amount, through 2025. Critical flaw: The TCJA omitted granting authority to the IRS to require all employees to refile their W-4s with their employers.

This anomaly has left employers and the IRS in a bind, since two radically different W-4s will be valid come next Jan.1; all pre-2020 withholding-allowance based W-4s and the 2020 W-4 (which is shaping up to be entirely different).

The IRS has recently released the second drafts of the 2020 W-4 and Pub. 15-T, which is the withholding instructions for employers. It wants you to start reprogramming your payroll systems now based on those drafts, since the final W-4 and the 2020 withholding tables probably won’t be available until sometime in November, at the earliest.

Here’s a closer look at what the IRS wants withholding to be next year.

2020 Form W-4

The IRS released the second draft of the 2020 W-4 in mid-August. It’s also said that the final form will not vary significantly from this draft.

Since withholding allowances are suspended for the foreseeable future, the IRS removed the word “Allowance” from the title of the form and the lines on the form on which employees can indicate them. Instead, the draft is built on five “steps.” Employees with the simplest tax situation—single, one job, no tax dependents, no other income or deductions—need only complete Steps 1 and 5. Steps 1 and 5 are the only mandatory steps.

Beware: If you use an electronic W-4, you’re going to have to make complimentary changes to it.

Step 1: Enter Personal Information

Similar to the 2019 W-4, employees enter their names, addresses and tax filing status.

What’s new: The draft eliminates the checkbox for married, withhold at the single rate, but adds a checkbox for heads of households. However, married couples can still check the box in Step 1c for single, married filing separately (even if they’re joint filers) if they want to increase their withholding, since there’s no mandate that employees change their W-4 status once they get married. Divorce is different: Couples who divorce must refile their W-4s within 10 days, if they were claiming married status.

Step 2: Multiple Jobs or Spouse Works

This step is optional for employees to complete.

Employees may account for up to two jobs (either their own second job or their spouse’s job) by checking the box in this step. By checking this box, employees will increase their withholding on a pay period basis by about 50%.

Step 3: Claim Dependents

This step is optional for employees to complete.

Employees who choose to take advantage of child and dependent care credits and other credits (e.g., the education credit) may complete this step. This is an annual reduction in employees’ tax liability for the year, and ultimately, their pay period withholding. Warning: The figures in Step 3 are geared toward claiming dependent credits. Employees who want to claim other tax credits should estimate the value of those credits.

Step 4: (optional) Other Adjustments

Employees account for other income, like capital gains, on Line 4a and other deductions on Line 4b. Employees increase the annual amount of wages subject to withholding by the amount shown in Line 4a and decrease the annual amount of wages subject to withholding by the amount shown in Line 4b.

Employees indicate any additional withholding to you on Line 4c. Currently, employees indicate additional withholding on Line 6.

Employees may claim an exemption from withholding by writing the word Exempt underneath Line 4c. Currently, employee write the word Exempt on Line 7 to claim an exemption form withholding.

Step 5: Sign here

Employees sign the form under penalties of perjury. Employees also date the form.

Pub 15-T

The IRS has taken the unprecedented step of releasing a third draft of Pub. 15-T. It’s also announced that it’s retiring Notice 1036, which was the advance issue of the next year’s withholding allowance amounts and percentage method tables. Henceforth, this information will be released in Pub. 15-T and posted to the IRS’ website here and here.

The IRS was coyer about when the 2020 percentage methods would be released. Sometime in December was all it was willing to say.

What’s new with Pub. 15-T

The IRS has clarified that if you’re withholding on periodic payments of pension income, you should use Worksheet 5 and the accompanying percentage method tables. You withhold using these tables regardless of whether retirees have filed the 2020 Form W-4P or have an earlier W-4P on file.

As with current withholding, if retirees haven’t provided you with a W-4P, withhold as if they were married, claiming three withholding allowances.

Although the IRS is still saying that these percentage method tables are for manual withholding systems, you might still want to think about having your IT department automate them.

The IRS also included a discussion of the alternate withholding methods. We’re not going to spend any time on these methods, since not many people use them. See page 20 of Pub. 15-T, if this is a concern to you.

The IRS has tried to square the circle of withholding-allowance based W-4s and the 2020 W-4 in Publ. 15-T. The key to Pub. 15-T is the employer worksheets and accompanying withholding methods; there are five of them:

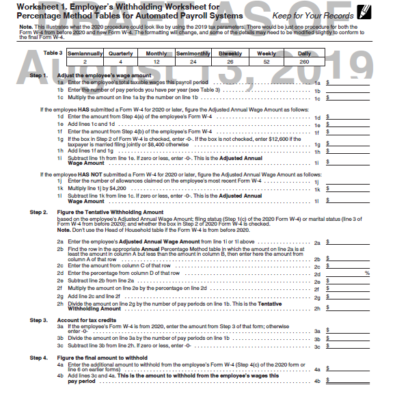

- Worksheet 1—Employer’s Withholding Worksheet for Percentage Method Tables for Automated Payroll Systems

- Worksheet 2—Employer’s Withholding Worksheet for Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later

- Worksheet 3—Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From Before 2020

- Worksheet 4—Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later

- Worksheet 5—Percentage Method Tables for Manual Payroll Systems With Forms W-4 From Before 2020

How to use Worksheet 1 and the accompanying percentage methods

Worksheet 1 is the most comprehensive of the five worksheets. It applies solely to automated percentage method withholding and is intended to be used for employees who file the 2020 W-4 and for those who don’t. Worksheet 1 must be completed before withholding occurs.

Worksheet 1 annualizes the withholding calculations and then converts those annual withholding amounts back into pay period withholding.

Step 1: Adjust the employee’s wage amount

At the end of Step 1, you will have calculated employees’ taxable wages. Step 1 applies to all employees.

- You complete Lines 1j through 1l for employees who don’t refile their W-4s for 2020

- You complete Lines 1d through 1i for employees who have filed the 2020 W-4.

Because Worksheet 1 applies to all employees, regardless of the W-4s they’ve filed with their employers, the IRS has been forced to use withholding allowances. Strictly for illustrative purposes, the IRS has used the 2019 annual withholding allowance amount of $4,200.

For employees who file the 2020 W-4, the following withholding allowances are entered on Line 1g:

- $126,000 (the value of three allowances), if employees checked the married, filing jointly box in Step 1c

- $8,400 (the value of two allowances), if employees checked any other box in Step 1c

- $0, if employees checked the box in Step 2c.

For employees who have pre-2020 W-4s on file, you enter the number of withholding allowances on Line 1j. Multiply that number by $4,200, and enter the result on Line 1k.

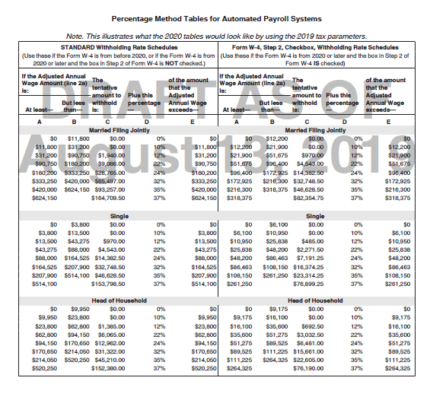

Step 2: Figure the tentative withholding amount

All employers must complete Step 2.

The mechanics of this step are the same as using any pre-2020 percentage method to figure employees’ withholding. The difference is that the percentage method tables aren’t based on pay periods, which is why the IRS is calling it figuring the tentative withholding amount.

After using the percentage method tables, completing Line 2h gets you back to tentative pay period withholding.

For employees with pre-2020 W-4s who didn’t request that an additional flat amount be withheld, or if employees who filed the 2020 W-4 didn’t check the box in Step 2c, claim credits in Step 3 or complete any entries in Step 4, the amount on Line 2h is their final pay period withholding. This amount should be carried over to Line 4a.

Step 3: Account for tax credits

You complete Step 3 of Worksheet 1 only if employees have made entries in Step 3 of their 2020 W-4s. Completing this step reduces employees’ tentative withholding amount on a pay period basis.

Step 4: Figuring the final amount to withhold

All employers should complete Step 4. Employers may simply carry over the amount from Line 2h. The amount of additional withholding, as indicated on Line 4c of the 2020 W-4 (Line 6 on pre-2020 W-4s), is entered on Line 4a. You add Line 3c and Line 4a to arrive at employees’ final pay period withholding.

Example

MTK Enterprises hires Nancy Gallagher in January 2020. She’s married with two kids and files joint tax returns with her husband. She’s paid $80,000 a year. MTK completes the Worksheet 1 as follows:

- It completes Lines 1d through 1i, since Nancy is a new employee who filed the 2020 W-4

- It completes steps 2, 3 and 4.

After completing these steps, Nancy’s withholding is reduced from $241.69 per biweekly pay period, to $87.84, thanks to her kids.

Worksheet 5: Percentage Method Tables for Manual Payroll Systems with Forms W-4 From Before 2020

If you have no employees who file the 2020 W-4 and hire no one during 2020, the IRS has provided traditional pay-period-based percentage method withholding tables.

Although these percentage method tables are accompanied by Worksheet 5, the worksheet is superfluous. And, while the IRS intends this worksheet and percentage method to be used with manual payroll systems, it’s probably not beyond the realm for your IT department to automate it, like it’s done in years past.