How to handle biweekly payroll

Updated 6/17/20

Employees don’t know pay periods; they know they get paid every two weeks. But there is a difference between paying biweekly, or 26 times a year, and semimonthly, or 24 times a year. And that difference comes into play when employees come onto or leave the payroll in the middle of a pay period.

Biweekly vs. semimonthly

Biweekly pay periods mean employees are paid every 10 days. Every other Friday, for example, is a common biweekly pay schedule. Depending on your pay date, you could have three biweekly pay periods in a month. Employees are customarily paid on the basis of 80 hours per biweekly pay period, not including overtime, of course.

On the other hand, pay dates for semimonthly pay periods are fixed—there are two per month, every month. Semimonthly pay periods usually begin in the first day of a month and run through the 15th and then the 16th through the last day of the month.

While the pay dates are fixed, paydays will vary every month. Because the number of days in a semimonthly pay period also varies, the key to semimonthly pay periods is hours worked, not days worked. One common measure is to pay employees for 86.67 work hours per semimonthly period (not including overtime), regardless of the number of days in the semimonthly period.

Prorating biweekly for new hires (and terminating employees, too)

Employers usually prorate the pay of new hires and employees who terminate in the middle of a pay period. If you pay biweekly, you pay by the day. It’s more complicated if you pay semimonthly. These employees should be paid by the hour. Result: Their prorated pay may be different from their regular semimonthly pay, depending on the number of hours they’ve worked.

Example. MTK, Inc., pays semimonthly on the 20th day of the month for work performed between the first and the 15th of a month and on the fifth day of the next month for work performed between the 16th and the last day of the month.

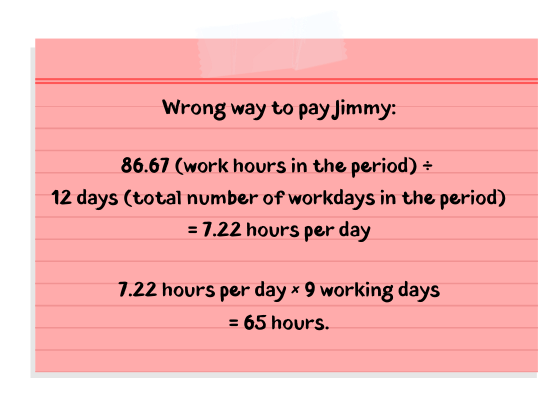

Jimmy was hired on the 21st day of a 31-day month, so this semimonthly period is 12 days long, of which he worked nine. Wrong way to pay: Jimmy receives pay for working 65 hours:

86.67 (work hours in the period) ÷ 12 days (total number of workdays in the period)

= 7.22 hours per day

7.22 hours per day × 9 working days

= 65 hours.

Right way to pay: Jimmy should be paid for 72 hours of work: 9 days × 8 hours a day.

Biweekly and semimonthly payroll practice tip

Employees have to be paid for every hour they work. You can prorate the pay of newly hired exempts or the pay of exempts who terminate, but they must still receive all their pay for all their hours worked. MTK, therefore, should make Jimmy whole and pay for those seven hours at the next pay period.

How to handle 27 biweekly payrolls in a leap year

Employees paid biweekly are paid 26 times a year. Except when they’re not. And they’re not every 11 or 12 years, when there are 27 biweekly pay periods. Employees paid weekly experience an extra pay period every five or six years. What’s up with this math? Well, nothing. The 27th/53rd pay period phenomenon is real and can cause havoc if you’re not prepared.

How and when 27 biweekly payrolls happens. Technically, there are 52.143 weeks (26.07 biweekly pay periods) in a nonleap year. These fractions of weeks accumulate and eventually create an extra payday. Depending on your payday, this will happen next year, when the 27th payday falls on Dec. 31, 2020. Why: Paydays occurring on holidays are usually pushed back a day and Jan. 1, 2021, is a holiday. Twist: If you don’t push the Jan. 1 payday back into 2020, you’d still have 27 biweekly pay periods, this time in 2021.

Who’s impacted. Only exempts and salaried nonexempts feel the full brunt of the 27th/53rd pay period phenomenon, because they’re paid annual salaries. Hourly-paid nonexempts are impacted only to the extent of withholding and deductions.

You have three choices for your exempts and salaried nonexempts, but no choice is trouble-free.

1. Do nothing. No federal or state agency requires you to adjust employees’ pay for the extra pay period. Although most companies choose this option, it may be a costly decision, since employees will receive an extra paycheck, along with extra taxes withheld and extra benefits provided.

2. Figure pay based on 52.143 weekly pay periods or 26.07 biweekly pay periods. This avoids the problem, but many payroll systems aren’t set up to deal with these fractions.

3. For the year the extra pay period occurs, divide employees’ salary by 53 or 27. Three problems arise. First, you can’t decide to do this in the middle of the year of occurrence. So you must plan in advance, getting all the appropriate departments—HR, Accounting, Finance, IT and the C-suite—on board. Second, this option creates a communications problem, since employees who thought they were earning, say, $2,000 every biweekly period will only receive $1,925.93. Lastly, check employment contracts and engagement letters to determine whether employees were promised a set annual salary.

What the IRS says about 27 biweekly

The IRS doesn’t vary the withholding tables to account for any extra pay period, but you may want to build the extra pay period into your computer formula. If you choose not to adjust, employees could be under-withheld.

Digging deeper. Employees’ benefits deductions and allowances (e.g., mileage allowances, parking allowances) may be affected if they’re normally figured by dividing an annual amount by 26 or 52. Ditto for bonuses that are based on actual wages paid. Best practice: List all benefits and deductions to determine whether they’re impacted:

- Medical, dental, life, vision, group-term life insurance, long-term disability, dependent care, flexible spending accounts and health savings accounts.

- Savings bonds, United Way, creditor and child support garnishments, deductions for other outside groups and other voluntary deductions.

- Accruals for vacation and sick pay.

Most payroll systems allow you to suppress benefits’ deductions for the extra pay period. If you choose to suppress deductions, the suppression usually occurs during the last pay period.

Think out of the extra pay payroll box

From a budgeting perspective, payroll is your largest expense. Consider: how the extra pay period impacts cash flow, month-end accruals, and forecasting (i.e., cash planning). In addition, 401(k) nondiscrimination testing may be affected. Best practice: To lessen the budgetary bite, plot paydays, and deposit dates on wall calendars for multiple years to determine the year during which the extra deposit must be made.