Glitch for PTO banks: Constructive receipt

According to the results of a recent survey by Mercer, 63% of employers use paid time off banks, or PTO banks, up from 50% just four years ago. Before you take the leap into PTOs, two private letter rulings from the IRS may temper your enthusiasm for them by dredging up the dreaded concept of constructive receipt.

Note: Private letter rulings are intended as private advice from the IRS to the requesting party. They may be used for informational purposes only; they may not be used or cited as precedent.

PTO time is taxable, but when? PTO banks combine employees’ vacation, personal and sick leave. Most PTO arrangements allow employees to roll over their unused accrued time into the next year. Payroll issue: When is the value of leave taxed—when employees earn it, when they roll it over or when they take time off? The answer depends on whether the accrued leave is subject to constructive receipt.

CONSTRUCTIVE RECEIPT: Constructive receipt is a tax timing issue. In addition to withholding when employees are actually paid, constructive receipt requires you to withhold when wages are constructively paid—that is, when wages are credited to the account of, or set apart for, employees so they can draw on them at any time.

In keeping with the rule of constructive receipt, the IRS has consistently concluded that the value of accrued leave is taxable when it’s earned, regardless of when or even whether employees take leave.

In the case referenced in Ltr. 9009052, employees could roll over unused accrued leave, but PTO banks were capped at 480 hours; the excess had to be cashed out. In addition, employees could cash out their leave at any time upon written request and 10 days’ notice.

IRS: Leave accruals are includable in employees’ gross income as they are credited to their accounts during the taxable year.

PAYROLL PRACTICE TIP: Your payroll system must ensure that employees who have been taxed on the value of their leave when it’s earned aren’t taxed again when they take leave, even if they take leave during the next calendar year.

Break the constructive receipt cycle. What if your PTO policy restricts cash outs by limiting them to a minimum number of hours once employees hit the ceiling on accruing time? For example, once employees’ banks hit 480 hours, they can cash out leave, but only in 50-hour increments. You’re still in the teeth of constructive receipt, according to Ltr. 9009052. IRS: The value of leave is taxable once employees hit the 50-accrued-hour mark.

You can, however, get out from under constructive receipt if employees are required to irrevocably choose during the preceding year whether they’ll roll over their unused leave or cash it out.

In that case, according to Ltr. 200130015, you’ve vanquished constructive receipt because you’ve put a substantial restriction on employees’ ability to cash out. Employees, therefore, are taxed on the value of their leave when they take it or cash out.

IRS: The mere right of employees to make elections under the plan doesn’t result in taxable income to them when the election is made; employees are taxed when leave is taken or the amounts are actually paid.

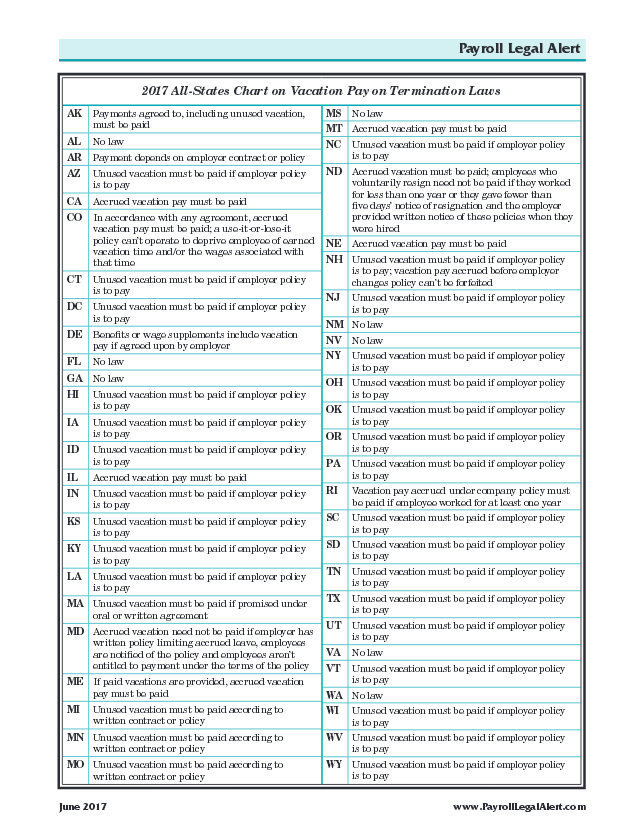

BYE-BYE, SO LONG, FAREWELL: As you can see, the right PTO policy can make a significant tax difference to you and your employees. However, regardless of your PTO policy, some states require you to cash out the value of a terminating employee’s accrued vacation days. The chart below summarizes those state laws. Some states don’t have laws, which means that company policy should prevail. Caution: To get the full story on state wage payment laws, contact your state labor department.

Click the chart image to download.